|

| Register | FAQ | Members List | Calendar | Today's Posts | Search |

|

#31

|

||||

|

||||

|

How just is our tax system when the wealthy pay property taxes based upon the value assessed. The higher the value the higher the tax. Commercial property valued differently then residential. But when it comes to business or personal income less is better? Why the difference?

Barney |

|

#32

|

||||

|

||||

|

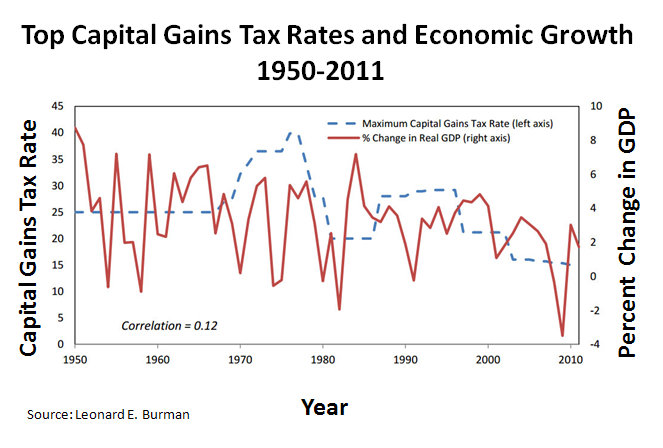

Why are regulatory remedies required? Capital gains rates have roller-coastered over time, and I'm not aware of any epidemics of corporate cashing in when's rates have been lowered.

|

|

#33

|

||||

|

||||

|

Quote:

|

|

#34

|

||||

|

||||

|

Nice chart. So how are you suggesting that it relates to what Don and I were discussing?

|

|

#35

|

||||

|

||||

|

Oh, and since you're quoting Burman, I believe the point he was making with that particular chart is this:

It's hard, if not impossible, to sort out the effects of capital gains tax cuts from all the other things that happened at the same time. I looked at the relationship between capital gains taxes and economic growth over many decades and the two time series are uncorrelated. That doesn't mean there isn't a relationship, just that it's not easy to see in the data. https://live.washingtonpost.com/capi...tax-rates.html |

|

#36

|

||||

|

||||

|

Hey Folks,

This is one excellent discussion. I am learning a tremendous amount. THANKS!!!

__________________

Instead of a debate, how about a discussion? I want to learn, I don't care about winning. Last edited by JCricket; 10-07-2016 at 08:44 AM. |

|

#37

|

||||

|

||||

|

Thanks for the actual data, Boreas. Looking at it, I think it's possible that a low capital gains tax incentivizes investment when growth is expected or happening, and encourages disinvestment when low growth or recession is expected or happening. Will tend to add volatility, therefore. An interesting question for research perhaps.

__________________

If you Love Liberty, you must Hate Trump! |

|

#38

|

||||

|

||||

|

I think the key is the volatility, the decade of the 1980s being very telling. A low capital gains rate is associated with both a near record period of negative GDP growth and a period of near record increase in GDP.

|

|

#39

|

||||

|

||||

|

Maybe that's simply a good case for setting the tax at a modest level and LEAVING IT THE HELL ALONE thereafter.

|

|

#40

|

||||

|

||||

|

Or at a rate similar to the one in effect during the most frequent periods of high GDP growth, or about 25%. 30% would appear to be too high and 15% too low.

|

|

«

Previous Thread

|

Next Thread

»

|

|

All times are GMT -5. The time now is 07:49 PM.

Linear Mode

Linear Mode